Beyond Transactions: SBLC for Importers

Are you an importer in search of a trustworthy option to protect your international trade beyond mere transactions? Complex dynamics exist in the realm of global trade; however, Standby Letters of Credit (SBLC) have become a significant tool for establishing trust, guaranteeing payments, and limiting risk.

Whether you are new to SBLC or want to further your knowledge in SBLC, this blog will help you understand the basics, and identify the best SBLC providers to effectively manage your import logistics.

Why Should Importers Choose the Right SBLC Providers?

In this section, we will explain how reliable SBLC providers add payment security, flexible trade solutions, and cash flow management, enabling importers to confidently pursue global markets. Let’s get started!

1. Strengthening Payment Security and Importer Confidence

An SBLC functions as a bank-backed promise to deliver funds to the exporter in the event of non-payment by the importer, thus eliminating all payment risk. This provides the importer with the certainty to negotiate trade terms that benefit him and build confidence with his suppliers across the globe.

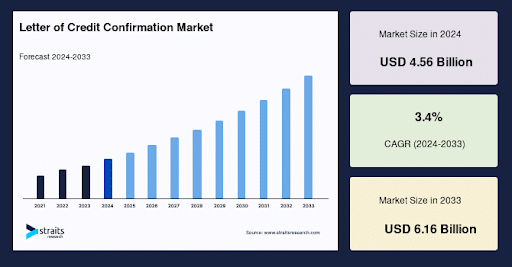

The global market for letters of credit confirmation, including SBLCs, was valued in 2024 at approximately $4.56 billion and is modeled to grow at a steady rate to $6.16 billion by 2033 at a CAGR of 3.4%.

Working with a reputable SBLC provider can provide certainty that any standby letters issued are legitimate and legally enforceable.

Importers who use a reputable SBLC provider are better able to instil confidence in their overseas partners. Additionally, when working with an experienced SBLC provider, will also help build transparency into the transaction and eliminate delays.

It is imperative that importers use a true SBLC provider that complies with the global compliance standards in order to operate with no financial loss.

2. Facilitating Flexible and Diverse Trade Transactions

SBLCs are very adaptable, and can be modified to meet the unique requirements of import contracts whether it be for goods delivery, performance of a service, or advance payments.

This flexibility from SBLC providers gives importers a chance to minimise many of the potential risks associated with unpredictable foreign currency regimes, geopolitical uncertainties, or delays in shipping.

SBLC is an established and reliable tool within the international financing ecosystem. A qualified SBLC provider knows how to structure, or customise, these guarantees to individuals’ specific trade needs to create more flexibility within a supply chain.

Importers can become more flexible when working with seasoned SBLC providers because they will have more options available to meet the unique requirements imposed by their own specific industry, market region, or transaction.

By working with genuine SBLC providers, importers will also benefit from reduced administrative burdens because documentation will take less time to develop, transactions will be quicker, and better cross-border compliance.

3. Enhancing Cash Flow Management and Reducing Collateral Pressure

Though banks issuing SBLCs will be concerned with the creditworthiness of importers and may require collateral to guarantee the SBLC, many importers find that the impact on cash flow is less than with advance payment or a traditional loan.

There is no standard method of assessing the fees banks charge to issue SBLCs, but they typically charge from 1% to 10% of the SBLC value on a per-annum basis.

SBLC providers allow importers to purchase goods without having to pay for them in full right away, which helps the importer conserve liquidity and run its operations as efficiently as possible.

Working with an experienced and genuine SBLC provider helps the importer to understand any collateral requirements, negotiate favourable terms on fees and navigate the documentation process seamlessly.

A reputable SBLC provider assures importers compliance with international banking regulations and compliance, as well as access to more favourable terms for transacting internationally.

4. Assisting Importers During an Increasingly Complex World Trade Environment

Growing complexity in global supply chains, compliance requirements and geopolitical uncertainties have led to increased demand for secure trade finance instruments such as Standby Letters of Credit (SBLCs).

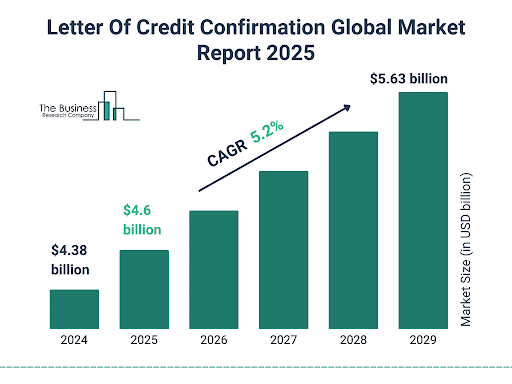

The letter of credit confirmation market, of which SBLCs make up a large part, is expected to grow from $4.38 billion in 2024 to $4.6 billion in 2025, at a compound annual growth rate (CAGR) of 4.9%, demonstrating the growing use by small-, medium- and large-scale companies around the world as an accepted trade finance tool.

In addition to the necessary security provided by genuine SBLC providers, importers from the global support and compliance, ensure their transaction-related legal requirements are addressed, and reduce delays.

5. Mitigating Risks of Non-Performance and Financial Defaults

SBLCs protect importers by ensuring that exporters comply with their contractual obligations. If they don’t, the SBLC allows the importers to recover certain losses through the invocation of the SBLC.

Exporters benefit from the assurance that they will get paid, even if the importer goes bankrupt or encounters cash flow issues; this effective risk mitigation provides importers and exporters with greater assurance for their respective international trade transactions.

As per the report, Europe is predicted to hold USD 1191 million with a CAGR of 2.2%. As a high-level regional trend, letters of credit, with issuing banks backing European lenders, appear to be on the rise. Concurrently, European SBLC providers are more frequently adopting distributed ledger technology regarding confirmation services.

Key Takeaways

- Working with trustworthy SBLC providers will provide security and clear sightlines in international trade transactions for importers.

- Experienced SBLC providers offer flexible options for various import contracts and minimise import trade risks.

- Trustworthy SBLC providers are hands-on in helping importers better manage cash flow by minimising collateral impacts and compliance obligations.

- In today’s uncertain global trading environment, working with genuine SBLC providers is a vital way to manage financial risk and ensure appropriate workflows.

Why Choose Pacific Corp as Your Trusted SBLC Provider?

As trusted and experienced SBLC providers, we offer customised, secure and transparent Standby Letter of Credit (SBLC) solutions to meet your specific business requirements.

Our straightforward process as genuine SBLC providers, from consultation, application, issuance and beyond, enables you to perform your financial obligations with ease, helping you to reduce risk, improve credibility and facilitate transacting throughout the cross-border process.

We know that you’re keen to make international trade simple; therefore, contact Pacific Corp today and witness how our SBLC services can accelerate your business development.

Get In Touch

Subscribe to Our Newsletter