How does Pacific Corp help with DLC and BG in the world of International Trade Finance?

In the high-stakes world of international trade, trust and timing are everything. Whether you’re shipping goods across continents or securing a contract for millions of dollars, financing them can make or break the deal.

Trade finance tools are powerful ways to mitigate risk in international trade, and they include Documentary Letters of Credit (DLCs) and Bank Guarantees (BGs).

Through this blog post, we will identify how these instruments function, as well as how we at Pacific Corp are reshaping international trade through better financial solutions with trust and safety.

Whether you are new to SBLC or want to further your knowledge in SBLC, this blog will help you understand the basics, and identify the best SBLC providers to effectively manage your import logistics.

What Are Documentary Letters of Credit (DLCs) and Bank Guarantees (BGs), and Why Are They Critical in International Trade?

Documentary Letter of Credit (DLC)

Bank Guarantee (BG)

The bank guarantee is a bank’s financial promise to cover the buyer’s non-performance, typically used in tenders and during high-value contracts. Bank guarantees consist of:

- Performance Guarantee, a commitment by the bank that the project will be completed.

- Bid Bond, is a commitment to support the bidding of the contract.

- Advance Payment Guarantee, a commitment to the recovery of the pre-payment.

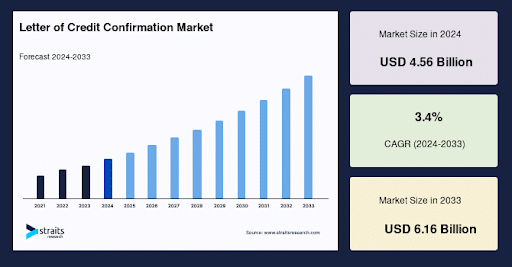

The Booming Confirmation Market: A Trillion-Dollar Ecosystem by 2033

As per the report, the performance bank guarantee market specifically is projected to increase from $9.3 billion in 2024 to $10.2 billion in 2025, at a CAGR of 9.7%.

Read through: Understanding Performance Bank Guarantees: Different Types and How They Work

Key growth factors are:

- Growing global trade, especially between regions with differing levels of political/economic stability is creating a higher necessity for confirmed L/Cs as a risk buffer.

- Need for customised trade finance solutions including fast confirmations and digital integrations.

- Regulatory regimes are tightening payment and counterparty risk protections for cross-border commerce.

How Pacific Corp Stands Out in DLC & BG Execution?

Pacific Corp delivers industry-oriented solutions for modern-day complicated trade needs:

- Fast Cycle Release: Rapid issuance of DLC enables seamless shipping cycles.

- Global Scope: Coverage in many jurisdictions and currencies.

- Cost-Effective BG Performance: Experience with bid bonds, performance guarantees, and other forms; instrumental in supporting project financing and tenders.

- Bank Network Delivery: Utilising SWIFT messaging for an average time of 9 days for both issuance of DLC and BG.

- Client Favourable Terms: Transparent fee structures and variable documents.

- Substantial Compliance: All legal enforceability while critically considering jurisdiction and regulatory specifications.

The Pacific Corp Advantage

| Features | Benefit To Trading Partners |

|---|---|

| Swift issuance | Reduces lead times for shipment and tender processes |

| Multi-jurisdictional & currency-ready | Suits emerging-market and multi-currency deals |

| Competitive, transparent fees | Lowers finance costs and improves ROI |

| Expert compliance support | Helps avoid disputes and ensures document compliance |

Navigating the Future of Trade Finance with Pacific Corp

In a world that is more interconnected now than ever, DLCs and BGs do not simply protect capital; they create the means for trade by allowing parties from different markets and legal systems to transact confidently.

- With the proliferation of digital ledger, we ensure to offer enhanced transparency, shortening timelines, and reducing fraud.

- We offer bespoke confirmation products for LMS, regional risk level, and ESG-linked transactions.

- Fintech partnerships developing hybrid offerings with technology innovations layered (AI automation, API issuance).

We are well-positioned to take advantage of these trends by incorporating financial products (DLC/BG) with digital acceleration, compliance, and customer lead.

Read through: Emerging Trends in Trade Finance: What’s Shaping 2025

Secure Global Trade Starts with the Right Financial Partner

While international trade continues to evolve and grow, DLCs and BGs represent the foundation of trust and security between global buyers and sellers.

By offering customised, technology-enabled solutions, Pacific Corp will guard your international transactions and ensure they are compliant, secure and confidently executed at every step of the journey.

Are you ready to start your global trade journey with less complexity?

Contact Pacific Corp today and find out how smart trade finance solutions can work for your business.

Get In Touch

Subscribe to Our Newsletter