How Is Trade Finance Beneficial?

What fuels international exchange and contributes immeasurably to the growth of economies? We are talking about trade finance. For business owners, entrepreneurs, and investors alike, knowing how trade finance works can prove to be a boon in so many ways. Here are the reasons why trade finance is essential and beneficial for firms and economies.

What is Trade Finance?

Trade finance represents all instruments and products utilized by businesses for international trade and commerce. It acts as an intermediary for buyers and sellers by providing ways of minimising risk in order to have a smooth transaction.

Trade finance minimises the uncertainty associated with cross-border transactions through instruments like letters of credit, trade credit insurance, and factoring, thereby giving rise to confidence and efficiency in the global market.

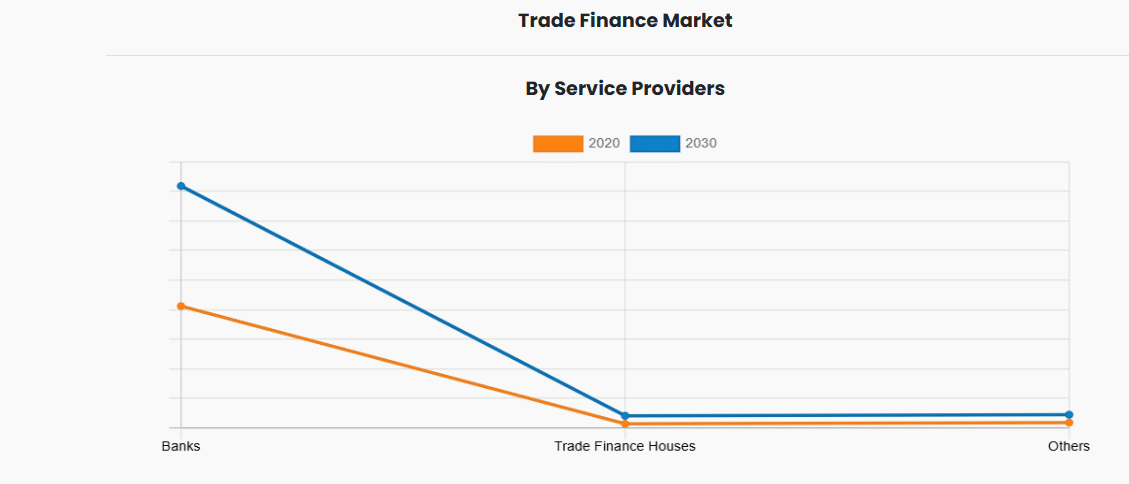

The global trade finance market was worth $44,098 million in 2020 and is forecasted to reach $90,212 million by 2030, growing at a CAGR of 7.4% during 2021-2030.

By region, the trade finance industry was largely dominated in 2020 by Asia-Pacific and is expected to maintain this position over the forecast period.

The emerging region of trade finance is Asia-Pacific which will boom after seeing a rise in emerging new technologies and simplifications in process flow in trade finance and all positive government processes in nations like India, China, Singapore, South Korea, and Japan, among others, in Asia-Pacific.

Increasing Emphasis on Safeguarding Trading Activities

Moreover, the developing need for trade finance is triggered by market challenges such as loss of investor confidence, market manipulation, fraud, and insider trading.

These developments have compelled financial firms to invest in technology-driven trade finance solutions where effective collection and tracking of structured and unstructured data will provide financial security for both importers and exporters.

Over the years, trade finance developed and addressed these risks by faster payments to exporters and ensured the actual shipment of goods through letters of credit (LC).

Now, as the industry progresses, service providers will expand their coverage for a more enhanced investor experience but should also stay to keep them competitive in the group.

Key Benefits of Trade Finance

1. Mitigating Currency and Political Risks with Trade Finance

The likely risks of currency changes and political uncertainties can affect international business transactions very much in terms of profitability. They consequently use the trade finance portfolio of hedging instruments and insurance products that can be employed to protect the business from any such threats.

Export credit agencies and private insurers cover risks of non-payment, be they related to political events, currency inconvertibility, or commercial disputes, and thereby assure the businesses in entering difficult markets.

Reports by the International Chamber of Commerce’s 2023 Global Survey on Trade Finance revealed that most banks, or 61%, reported an increase in claims on political risk insurance in emerging markets.

2. Dealing with Cash Flow Challenges

The time taken between production, shipping and receipt of payment can create a strain in finances, more notably for smaller businesses.

Trade finance solutions offer working capital during these times that allow exporters to receive payments shortly after shipment while importers can hold on to their extended payments.

Synchronising cash flows would keep business operations running even in terms of long international shipping and customs processes.

3. Providing Access to Competitive Financing Options

With trading finance, companies can open up different channels of financing that cannot be made available via conventional banking sources.

Trade credit, factoring, and supply chain financing are a few examples of investment options that allow a company to access funding depending upon the strength and nature of its international transactions rather than collateral alone.

This type of approach proves very useful, particularly for those companies with limited exposure to conventional loans or those wanting to have maximum flexibility with working capital.

4. Aid in Regulatory Compliance

There are a few regions available for international trade, each with its regulatory regime. Over time, trade finance institutions have developed adequate expertise in documentation, compliance, and risk assessment for these areas of business so that companies can adequately meet such competencies.

By partnering with the right aid in trade finance, firms can reduce their levels of perceived compliance risk and improve their core business activities.

Our Trade Finance Solutions: Empowering Your Business Growth

Pacific Corp offers trusted trade finance solutions that keep your supply chain running smoothly to assist your business expansion.

Through us, you get all kinds of trade finance solutions, starting with Letters of Credit , Standby Letters of Credit, such as SBLCs, Bank Guarantees, Performance Guarantees, or Advance Payment Guarantees, Proof of Funds (POF), and many more.

With our extensive experience and thorough understanding of various industries, we offer solutions tailor-made for your specific needs of business. So whether you’re a trader, importer, exporter, or just a consultant, we offer you all those reliable and reasonably priced trade finance services that ensure your success.

Get In Touch

Subscribe to Our Newsletter