Tips for Securing Trade Finance for Your Business

Are you aware of the hidden risks that could jeopardise your business in trade finance transactions?

Trade finance plays a crucial role in today’s global economy. Many businesses participate in cross-border transactions involving goods and services, navigating both opportunities and risks in their trade activities.

In this blog, we will discuss the most prevalent forms of trade finance fraud, identifying “red flag” types, which businesses readily overlook, and tangible means to protect your trade finance transactions.

Top Fraud Prevention Tips in Trade Finance

1. Digitise Trade Documents Using Blockchain Technology

Traditional paper-based documentation has been a significant weakness that fraudsters have historically exploited in trade finance.

To improve fraud mitigation within their organisations, many are now turning to blockchain technology, which enables organisations to digitise trade documents. Blockchain offers a shared, tamper-proof, transparent ledger.

Once a trade finance document is recorded on the blockchain, it becomes tamper-proof, making any alterations easily detectable. This helps tackle major fraud concerns, reduces the risk of fraud, and enhances trust in trade finance transactions.

Based on information provided by the International Chamber of Commerce (ICC), companies can expect to realise a fraud reduction of up to 80% through digital trade finance documentation delivered using blockchain, simply because it provides businesses with a viable method of validating a transaction, and guaranteed protection against forgery or duplication of documentation.

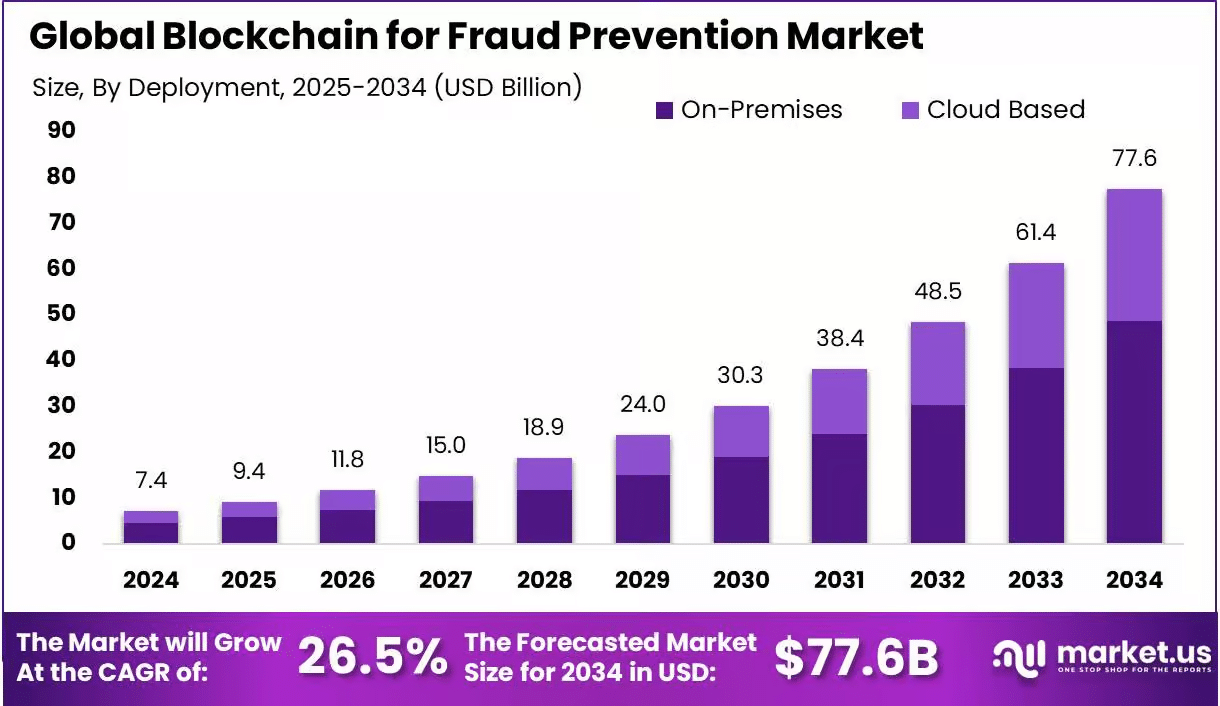

According to a recent report, the global blockchain for fraud prevention market was anticipated to grow from USD 7.4 billion in 2024 to USD 77.6 billion by 2034, at a compound annual growth rate (CAGR) of 26.5%.

As fraud prevention continues to be a shared agenda and priority for organisations globally, blockchain has increasingly positioned itself as an emerging technology that businesses and policymakers may rely upon to minimise risk in trade finance, while at the same time, maximising efficiency.

2. Perform Regular KYC and Enhanced Due Diligence in Trade Finance

Conducting good KYC and Enhanced Due Diligence (EDD) is vital in fraud mitigation for trade finance. Performing KYC on clients, suppliers, and third parties helps prevent fraud before a transaction occurs.

Since over 60% of businesses plan to increase fraud prevention investments, due diligence has become a key strategic priority. If checks are embedded into trade finance workflows, stronger compliance, reduced risk, and more comprehensive fraud prevention outcomes will be realised.

3. Use Real-Time Monitoring for Trade Finance Fraud Prevention

Real-time monitoring is a vital element of any fraud prevention strategy in trade finance. It assists in the identification of suspicious activities such as shipping routes that conflict, duplicate financing or invoice imbalances.

Trade finance automated systems can identify suspicious transactions more quickly than manual checks, which helps fraud investigations. Businesses using real-time monitoring, according to the ACFE, detect fraud 50% faster, allowing you to mitigate losses more significantly.

As fraud prevention continues to escalate in importance for trade finance practitioners, various real-time monitoring tools should be included in any trade finance risk management strategy, and can greatly enhance accuracy, tracking capabilities and proactive fraud prevention practices.

4. Prioritise Cybersecurity in Trade Finance Fraud Prevention

Cybersecurity plays an important role in fraud prevention in trade finance and is often neglected. Businesses must secure their trade finance systems using the security features built into these systems, such as 2FA or multi-factor authentication, encryption, and strong credentials for users.

According to the World Economic Forum, 20% of trade finance fraud losses arise from many cyberattacks, such as phishing and poor access controls.

A secure digital environment not only protects privileged data from unwanted access but also enhances fraud prevention measures. In today’s digital world, strong cybersecurity is mandatory to operate trade finance safely and in compliance while supporting long-term fraud prevention.

5. Leverage AI and Analytics for Smarter Fraud Prevention in Trade Finance

The use of advanced analytics is changing the way that fraud risk has been prevented in trade finance. Applications such as machine learning and anomaly detection can rapidly analyse transaction patterns to flag anomalies in real-time.

Regulatory Technology (RegTech) is changing the landscape of compliance management in the financial institutions space, particularly in the realm of anti-money laundering (AML) and compliance with applicable AML regulations.

The global RegTech market is forecasted to grow at a compound annual growth rate (CAGR) of 23.5% and exceed $22 billion by mid-2025.

With RegTech solutions that provide tools for KYC, sanctions screening, transaction monitoring, reporting of financial crimes and other compliance functions, it is reducing individual costs and improving operational efficiencies in a context of constant regulatory change.

AI and its use cases allow fraud prevention teams to be more fast and intelligent, as well as reliable. With the growth of digital trade finance, applying advanced analytics through AI and other technologies is essential to prepare for future fraud threats and enhance the overall fraud prevention plan.

Securing Your Success: Trusted Trade Finance with Proven Fraud Prevention

In a rapidly evolving and technologically driven global marketplace, protecting your financial transactions is no longer a choice, but a necessity. At Pacific Corp, we offer comprehensive trade finance solutions and tailor them to fit your business.

We focus on fraud prevention through transparency, compliance, and reputable partners, while offering assistance with letters of credit, bank guarantees, performance bonds, and more.

Our team is dedicated to handling everything with professionalism and integrity. Let us help you at Pacific Corp, where secure financing intersects with smart trade.

Get In Touch

Subscribe to Our Newsletter