Advantages and Disadvantages of Bank Guarantees (BG)

In the global economy today, the challenges posed by financial risk management while driving business momentum are present for companies of all sizes. Bank guarantees have become critical instruments to facilitate cross-border and cross-sector commercial engagement within a framework of financial security and mutual trust attached to all parties involved.This blog will help you unravel the relative advantages and disadvantages of bank guarantees to deliver a managerial note to organisations wishing to smarten their financial strategies and widen their business horizons.

What is a Bank Guarantee?

A bank guarantee is a financial document, under which a bank agrees to meet the obligation of a client in case of default. In international trade, bank guarantees reduce the trust deficit between parties in different countries through reassurance that payments would be made or contractual obligations would be met in case of default on one side or the other, thereby enabling confidence and carrying out cross-border transactions that otherwise could be too risky.Global Bank Guarantee Overview

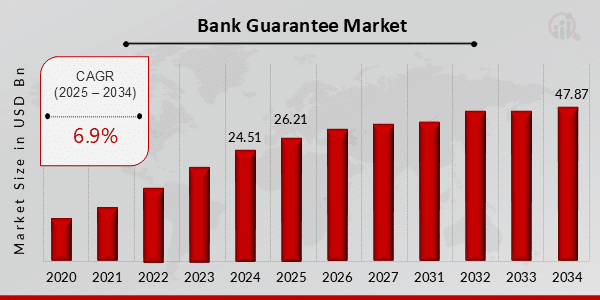

As per Market Research Future Reports, the Bank Guarantee Market Industry is expected to grow from 26.21 billion USD in 2025 to 47.87 USD billion by 2034, showing a compound annual growth rate (CAGR) of 6.9% during the forecast period (2025 – 2034).

Advantages of Bank Guarantee

1. Enhanced credibility and trust

Besides enhancing credibility, bank guarantees imbue a business with additional trust. Companies look more trustworthy when a credible financial institution backs them. A 2023 survey conducted by the International Chamber of Commerce indicates that companies with bank guarantees are 37% more likely to win international contracts compared with companies that do not have such guarantees.2. Risk mitigation

The transferring of financial risk from the beneficiary over to the bank is merely risk management in disguise. This acts as insurance for more high-value transactions where the risks are high. If used correctly, bank guarantees bring down the risk of nonpayment by up to 78% in cross-border trade.

3. Access to large contracts

By providing bank guarantees, smaller enterprises are in a position to bid for larger contracts that otherwise would be out of their reach financially. Reports from small business association officials show that, thanks to bank guarantees, SMEs could handle a 40% increase in contract value.

4. Performance enhancement

Bank guarantees would enhance the contractor’s and supplier’s performance standards. Once a company knows that a financial institution is backing their performance with a guarantee, the probability that the company will fulfill or even exceed its contractual obligations is quite high. Research by the International Project Management Association states that performance guarantees add to an impressive 31% more timely completions of projects than projects that do not have performance guarantees.5. Lower interest rates compared to loans

When compared to loans, bank guarantees are likely to be a better option. While a short-term business loan charges 7%-12% interest, bank guarantee fees are charged at 0.75%-2.5% annually. Because of this, bank guarantees are financially favourable in most cases over direct financing options.6. Regulatory compliance

In many industries, bank guarantees support businesses in fulfilling regulatory requirements. In this case, the construction, real estate development, and energy sectors see bank guarantees being demanded to prove financial capability and commitment. Regulatory compliance through bank guarantees has reduced legal disputes in their subsequent steps and processes by 67% in highly regulated sectors.

Disadvantages of Bank Guarantees

1. Collateral requirements

A lot of collateral is required to be issued guarantees by banks. In most cases, banks require almost 100% of the guarantee amount, which can impair liquidity and restrict the ability of management to avail of other financial assistance in support of their investments. Some reports from the banking industry estimate about 85% of bank guarantees require some kind of collateral.2. Impact on borrowing capacity

If a bank guarantee comes into play, it often gets counted as part of the overall credit limit assigned to a company by a financial institution. The Corporate Finance Institute says that companies with large bank guarantees can count on a decrease in their additional borrowing capacity of, on average, 30%, according to a 2024 report. Although there may be some drawbacks concerning bank guarantees, essentially at Pacific Corp, we are here to help you in overcoming the obstacles and give you guidance all the way through.Pacific Corp: Unlocking Global Opportunities with Trusted Bank Guarantees

At Pacific Corp, we fully appreciate that bank guarantees are ways of reducing risk and, in fact, are worth their weight in gold because of the options they present for growth and opportunity in the international trade arena. Whether you are an importer, exporter, or contractor, these financial instruments provide the trust and security that are essential in forging successful business partnerships across borders.With our experience in trade finance, including bank guarantees, letters of credit, and performance guarantees, we help businesses navigate confidently through global trade complexities.Get In Touch

1st Floor, Suite 4, Europa House, Packhorse Road, Gerrards Cross, Buckinghamshire, SL9 8BQ, United Kingdom

Phone :

Email :

Subscribe to Our Newsletter

Pacific Corp © All Rights Reserved , 2024